Asset allocation was most likely coined by the identical one that forbade us from placing all our eggs in the identical basket. No less than in precept. Asset allocation is the diversification of your investments throughout totally different asset lessons to mitigate market dangers. In any case, placing all of your funds in a single asset class is kind of much like placing all of your eggs (cash) in the identical basket (asset).

All asset lessons have totally different threat publicity and behave in a different way to market circumstances. While you put money into belongings with contrasting habits, one would reply positively in a market situation as the opposite fall. Thus, a few of your belongings will shield you from the loss attributable to one other part of your funding. That is the significance of asset allocation in very transient phrases.

HOW IS ASSET ALLOCATION DONE?

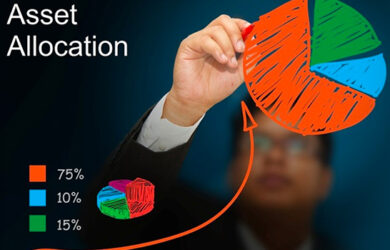

The funding type of every investor would dictate how they perform asset allocation. Elements just like the investor’s age, threat urge for food, and earnings are essential in forming their mutual funds’ funding type. A younger particular person with a better threat urge for food might select to speculate, let’s say, 60-70% of his or her funds in equities, whereas somebody nearing retirement is extra more likely to play it protected with a debt-heavy asset portfolio.

Buyers at all times need to optimize their mutual funds‘ returns by asset allocation. By retaining a portion invested in several types of belongings, they search to faucet the expansion of every of them. Together with optimization, asset allocation additionally ensures {that a} crash in a single asset doesn’t pull your general portfolio down. As an illustration, in case your fairness funding performs poorly as a result of plummeting market circumstances, your funding in gold is more likely to soar because of the ‘protected haven’ tag that gold enjoys amongst traders.

INVESTMENT TENURE AND ASSET ALLOCATION

Asset allocation selections are taken retaining the aim of the funding and time horizon in thoughts. A newbie investor seeking to construct a retirement corpus would align their mutual funds on-line with fairness investments extra aggressively as there’s a longer time horizon. A dad or mum saving in SIP for a house down cost would allocate extra in conventional and safer belongings because of the shorter time-frame and nature of requirement. Medium-term objectives can see asset allocation in a hybrid method, with investments in equities and money owed and bonds.

HOW IT HELPS YOU?

Panic and temptation may be detrimental for any investor. A booming market can tempt us to speculate closely in high-performing belongings, whereas a market crash could make us withdraw out of concern. Asset allocation addresses each by sustaining a steadiness in your general portfolio’s efficiency. It additionally permits you flexibility in your investments. You may, and will, assessment your mutual funds on-line repeatedly and rebalance them to weed out underperforming investments and faucet rising belongings.

To resolve the asset allocation of your mutual funds on-line, numerous apps present a user-friendly interface and beneficial evaluation of schemes. Tata Capital Moneyfy app may be the proper device for traders to handle their SIP extra optimally and derive extra returns from it.